Innovation often happens when dots are connected, and payments are no different. Why digital payments need interconnection This is the sort of user experience that could not exist in a world of paper, nor could it be built with system architectures that are not designed to be interconnected to other applications in real-time. At the same time, data from the receipt could be used by your fitness app to nudge you when you buy candy and your personal wealth finance app to suggest where you could buy same products for less. For example, a digital receipt from a grocer could automatically be sent your smart refrigerator and recipe apps to manage your supply of needed ingredients. The next evolutionary phase is building systems of intelligence that can provide insights via artificial intelligence (AI) and machine learning (ML). Banks and payment companies are now at this point in their paperless journey, and it involves being able to access and process data sets, which may be from different domains, in real-time. According to Moore, the next step in a digital systems maturity is a system of engagement, which leverages mobile applications and omni-channel communications to improve the customer experience and reduce transaction time. Renowned business author Geoffrey Moore describes this as a system of record.

#PAPERLESS PAYMENTS PDF#

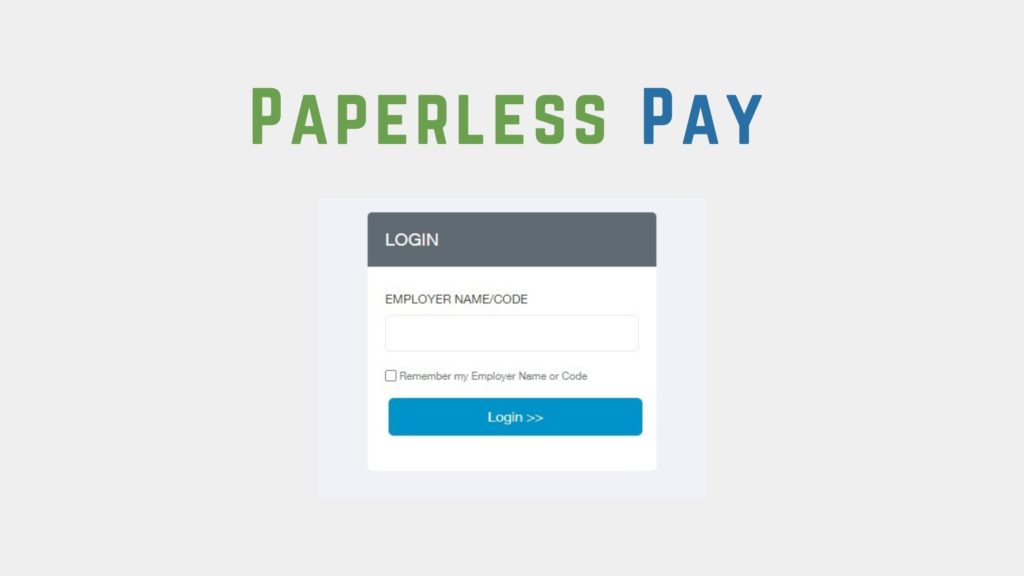

The shift to paperless began with exporting the paper record to an electronic format that could be accessed via a screen – for example, viewing your PDF bank statements from your mobile phone. It’s a real-time process that uses insights to do just-in-time funding.įrom systems of record to systems of engagement Once I use the card, I’m done – there’s no expense report to file because it’s all automatic. When I’m on a business trip, my boss can instantly fund pre-approved amounts for meals, hotels, etc. EBA Clearing, a payment infrastructure provider, launched a RTP solution in Europe with 26 payment service providers last year.

In a click of a button, the payer can choose to pay in full, request an extension or other options. RTP enables any business or individual that needs to receive payment to send an electronic payment request to the debtor account. Request to pay: Fintechs are starting to close the gap in paperless billing processes with request-to-pay (RTP) functionality. Divvy provides employees with spending cards that executives can fund instantly via a dashboard, making it easy to track corporate spending. Brex underwrites the borrower based on current data to determine credit limits, enabling them to issue cards to small businesses that can’t otherwise obtain corporate credit cards. Paperless expense reports: Fintech startups like Brex and Divvy are providing real-time expense report systems to help businesses of all sizes. The National Bank of Australia has incorporated Slyp into its mobile app to help its customers access receipts for managing spending and addressing tax requirements. Flux offers a platform for banks and retailers to power digital receipts and rewards. Digital receipts: Companies like Flux and Slyp are delivering retail receipts into banking applications and more. Taking it one step further, Monzo allows users to customize their own automations such as dropping cash into savings when they visit the gym or having a smart light in the home flash red if you are running low on cash.

Digital banking upgraded: Challenger “digital native” banks like Starling and Monzo are on the rise because they are providing value-added insights and services such as integration with digital receipts and accounting systems. Central to all of these is fast, secure and reliable data exchange between ecosystem partners. And technologies such as cloud, 5G, blockchain and artificial intelligence (AI) are paving the way for new entrants to offer innovative services. Digital payment ecosystems already include a rich variety of participants that collaborate in real-time to deliver fast, secure transactions for customers. The key to delivering better value is real-time data exchange. Re-imagining payments in a paperless world

0 kommentar(er)

0 kommentar(er)